The tale of two Apple Pay surveys.

There have been some conflicting surveys out about Apple Pay in the last couple of weeks, one of which says the mobile payment service is growing and the other, declining. So, which is it?

The Auriemma Consulting Group survey is clear and up front about where the data comes from, is easy to read, and comes off as professional and, well, sane:

Apple Pay usage in the US is growing, driven by both increased frequency of transactions and the expanding base of iPhone 6 owners, according to Auriemma Consulting Group’s Apple Pay Tracker, which interviewed 500 iPhone 6 and 6+ owners between May 29 and June 15, 2015. Forty-two per cent of Apple 6/6+ owners reported having used Apple Pay, virtually identical to the proportions reported in two previous waves of the study conducted in February and April 2015. “While the proportion of users has remained stable, the denominator has grown through new iPhone and Apple Watch sales and the upgrade cycle. We’ve also seen the average number of transactions increase both in-store and in-app,” says Marianne Berry, Managing Director of ACG’s Payment Insights practice.

They go on to say Apple Pay is considered to be move than a novelty, is growing at points of purchase, and that there appears to be lots of room for further growth.

The PYMNTS/InfoSocut is the opposite. It’s almost impenetrable, written as half-narrative about a conference, doesn’t clearly say where the data comes from, and is filled with comments from people who appear to have competing interests to Apple Pay—including the CEO’s of Paypal owned Paydient and Samsung-owned LoopPay. Which is, frankly, bizarre.

In March, survey data indicated that 15.1 percent of eligible Apple Pay users had tried the service – when surveyed in June 2015 that had fallen to 13.1 percent.

Usage fell as well – when asked in March, “Did you use Apple Pay on this transaction,” 39.3 percent of consumers said yes. When asked the same question in June, only 23 percent replied in the affirmative.

They go on to say Apple Pay has dipped with committed users and that Apple Pay doesn’t sell phones. Then they go into the appalling quotes from competitors.

iMore hasn’t looked into Apple Pay usage among iPhone owners yet, but we did ask Apple Watch owners as part of our ongoing survey. We’re only a quarter of the way through the data collection phase right now, but with thousands and thousands of responses in already, the numbers are currently as follows: 60% have used Apple Pay at least occasionally, and over 30% use it whenever it’s available to them.

That’s for a service that, until very recently, was only available in the U.S., is still only available in the U.S. and U.K., is still adding banks and retailers, and won’t be launching support for loyalty and store cards until iOS 9, later this fall.

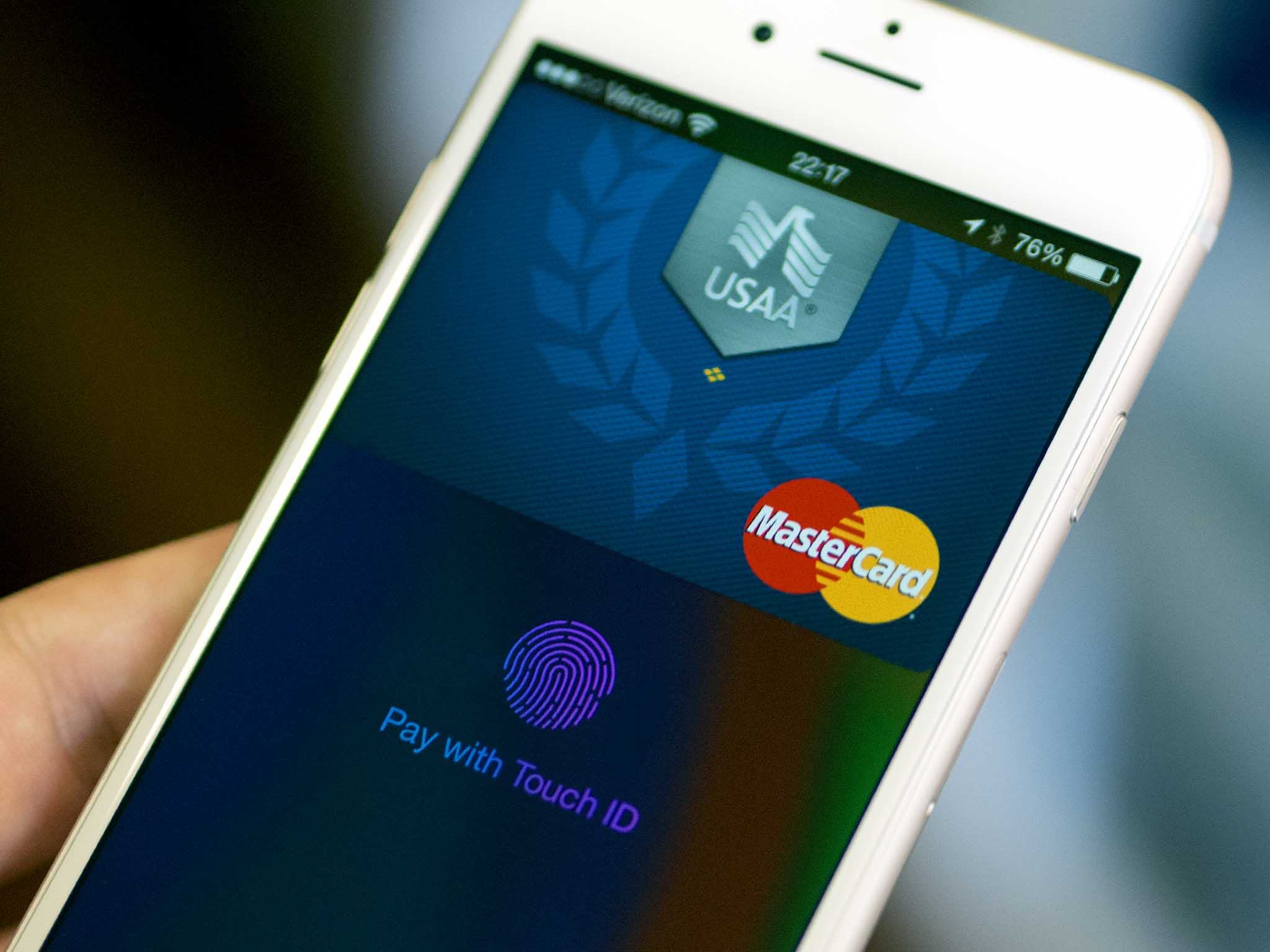

Still, we’ve seen how Apple Pay accessibility can empower people:

That Apple Pay on the iPhones 6 (and [the] Apple Watch) works so effortlessly that it instills feelings of empowerment and independence for users with disabilities is profound.

How Apple Pay is automagically secure, which literally turns what previously was an extremely stressful experience into a delightful one:

The first time you experience this seamless transfer of your accounts with Apple Pay, you’re going to want it everywhere you purchase goods and services. That, combined with very positive word-of-mouth, is going to make entering a card number feel very antiquated. And I suspect this change will come about very quickly.

And how great Apple Pay is to use on the London Underground:

Apple Pay is a great way to get around London. Keep your wallet safely tucked away in your bag or pocket and better keep track of your transactions. I managed to visit London for two full days without using the debit card connected to my Apple Pay

Without more data, it’s impossible to tell with an absolute certainty which set of numbers most accurately present the current state of Apple Pay growth. It’s pretty easy, however, to judge the companies presenting the data. AGC is clean, clear, and professional. PYMNTS/InfoSocut rings just about every integrity alarm bell imaginable.

Negative Apple headlines drive a lot of attention, though, so it’s no surprise the negative numbers are getting a lot of pickup. Still, it’s better to look at both sets, and both companies, and match what they say against your own experiences, and then decide for yourself.

For me, I’ll be using Apple Pay as much as possible as soon as possible.

View full post on MobileNations